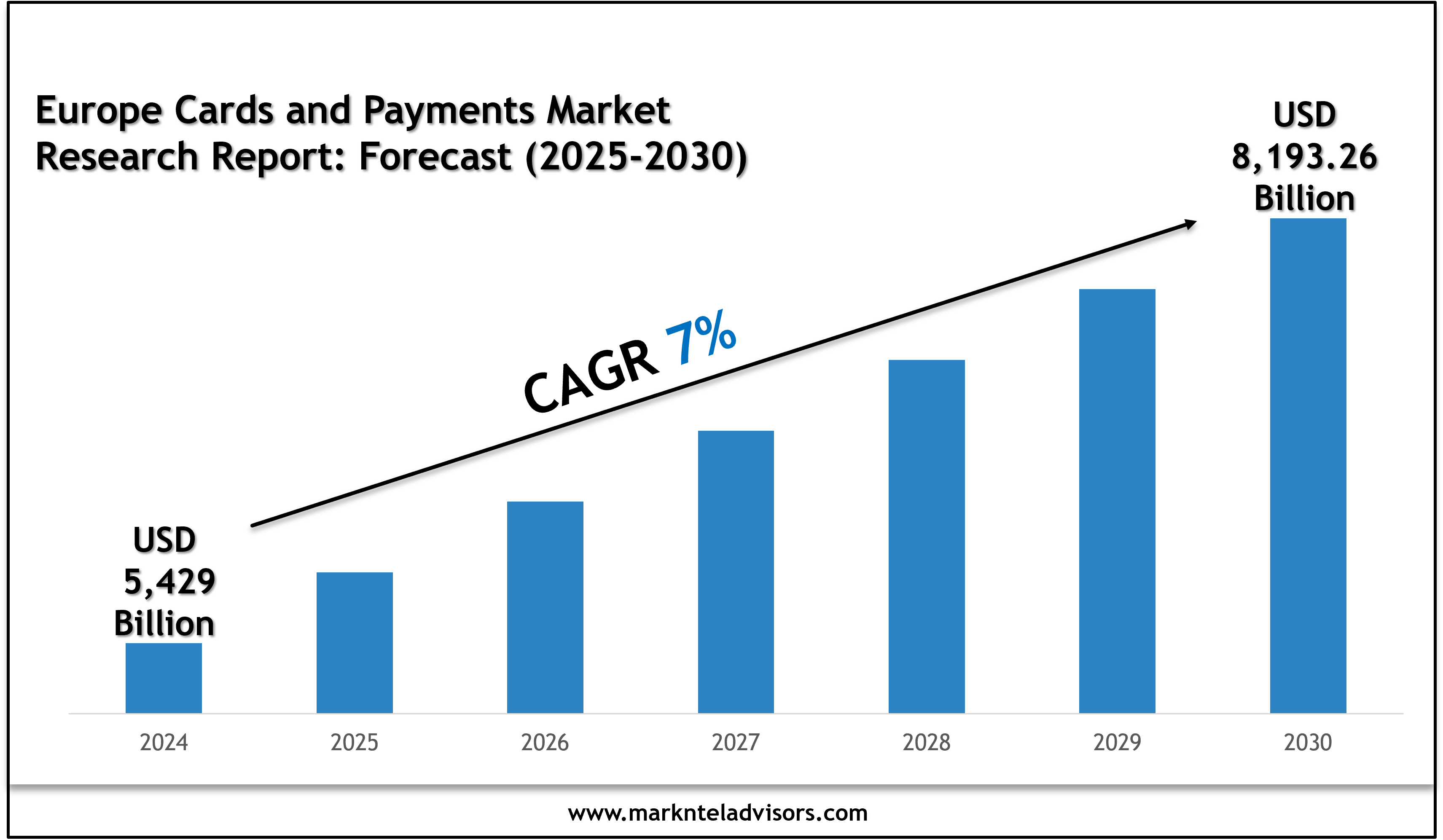

Europe Cards and Payments Market Trends: Growth, Share, Value, Size, and Analysis By 2030

As per MarkNtel In 2024, total value of transaction in Europe Cards and Payments Market was around 5,429 billion, and is projected to surpass 8,193.26 billion by 2030. Along with this, the industry is also anticipated to grow at a steady CAGR of around 7% during the forecast period, i.e., 2025-30.

Europe Cards and Payments Market Systems Market Insights:

As the region moves further into a cashless society, the Europe Cards and Payments Industry size is poised to register robust growth through 2030, supported by increasing card penetration, rapid adoption of contactless and mobile payments, and the strategic integration of biometric security features.

In case you missed it, we are currently revising our reports. Click on the below to get the latest research data with forecast for years 2026 to 2032, including market size, industry trends, and competitive analysis. It wouldn’t take long for the team to deliver the most recent version of the report.

Explore the Insights – Download a Free Sample: https://www.marknteladvisors.com/query/request-sample/europe-cards-payments-market.html

Europe Cards and Payments Market Systems Market Segmentation:

By Type of Cards

- Debit Cards- Market Size & Forecast 2020-2030, (Units)

- Prepaid Cards- Market Size & Forecast 2020-2030, (Units)

- Credit Cards- Market Size & Forecast 2020-2030, (Units)

By Type of Payment Instrument

- Cards- Market Size & Forecast 2020-2030, (Units)

- Mobile Wallets- Market Size & Forecast 2020-2030, (Units)

- Credit Transfers- Market Size & Forecast 2020-2030, (Units)

- Cash- Market Size & Forecast 2020-2030, (Units)

- Cheques- Market Size & Forecast 2020-2030, (Units)

By Type of Payments

- B2B- Market Size & Forecast 2020-2030, (Units)

- B2C- Market Size & Forecast 2020-2030, (Units)

- C2C- Market Size & Forecast 2020-2030, (Units)

- C2B- Market Size & Forecast 2020-2030, (Units)

- E-Commerce Payments- Market Size & Forecast 2020-2030, (Units)

- Payments at POS Terminals- Market Size & Forecast 2020-2030, (Units)

By Transaction Type

- Domestic- Market Size & Forecast 2020-2030, (Units)

- Foreign- Market Size & Forecast 2020-2030, (Units)

- By Application

- Food & Groceries- Market Size & Forecast 2020-2030, (Units)

- Health & Pharmacies- Market Size & Forecast 2020-2030, (Units)

- Travel & Tourism- Market Size & Forecast 2020-2030, (Units)

- Hospitality- Market Size & Forecast 2020-2030, (Units)

- Others (Media & Entertainment, etc.)- Market Size & Forecast 2020-2030, (Units)

By Country

- Germany

- The UK

- France

- Italy

- Spain

- Rest of Europe

Europe Cards and Payments Market Recent Development:

- March 2024: BNP Paribas rolled out SEPA Instant Payments in Ireland, enabling euro transactions to settle in under 10 seconds, 24/7. This initiative supports corporate clients with real-time liquidity management and complements existing solutions like virtual accounts and FX+ Payments, strengthening BNP’s position in cross-border transaction banking.

- 2025: BNP Paribas and Groupe BPCE announced a partnership to combine their payment processing operations, with the ambition to become one of the top three European players in the sector.

Tap into future trends and opportunities shaping the Europe Cards and Payments Market complete report: https://www.marknteladvisors.com/research-library/europe-cards-payments-market.html

Europe Cards and Payments Market Drivers:

Regulatory Support for Open Banking and Instant Payments – One of the key forces accelerating the growth of the Europe Cards and Payments Market is the robust regulatory backing for open banking infrastructure and instant payment systems. The European Commission's proactive stance in creating a harmonized digital finance ecosystem is transforming the payment landscape from card-centric to API-driven, bank-to-bank transaction models. Countries like the Netherlands, Sweden, and Finland are already seeing A2A (account-to-account) payments erode traditional card volumes in specific sectors such as utilities, e-commerce, and recurring billing. For example, Sweden’s Swish app processed over 1 billion payments in 2023, primarily peer-to-peer and merchant transactions—illustrating consumer comfort with bank-led, non-card alternatives.

Report Highlights Essential Insights for Strategic Decision-Making

- Detailed market size, share, and forecast analysis

• In-depth pricing trends and segment-wise cost evaluations

• Key industry strategies, including innovation, partnerships, and acquisitions

• Critical value chain analysis and stakeholder profiling

• Regional import-export market insights and trade flow assessment

• Thorough competitive benchmarking of top hearing aid manufacturers

• Identification of new growth opportunities and niche market segments

• Overview of market trends, drivers, and challenges shaping future demand

Some of the leading players in the Europe Cards and Payments Market are:

- HSBC Holdings

- BNP Paribas

- Sabadell (Banco Sabadell)

- Banco Santander

- Barclays

- Société Générale

- UBS Group

- Deutsche Bank

- CaixaBank

- ING Group

- Paypal

- Apple Pay

- Google Pay and others.

Report Delivery Format – Market research reports from MarkNtel Advisors are delivered in PDF, Excel, and PowerPoint formats. Once the payment is successfully processed, the report will be sent to your registered email within 24 hours.

Select a License That Matches Your Business Requirements with Instant Offer - https://www.marknteladvisors.com/pricing/europe-cards-payments-market.html

Research Methodology Summary

A systematic approach is used to ensure accurate market insights, combining both bottom-up and top-down methods. Data triangulation validates findings from multiple angles.

Key Steps:

- Define objectives and research design

- Collect data through surveys and interviews

- Analyze and validate data using reliable tools

- Forecast trends and deliver actionable insights

About us:

MarkNtel Advisors is a prominent market research and consulting firm delivering data-driven insights across the financial technology (FinTech) ecosystem, including omnichannel banking, digital payments, and core banking infrastructure. We analyze digital transformation trends and regulatory frameworks to help financial institutions and investors build future-ready strategies. Through Competitive Intelligence, we provide clients with benchmarking tools and strategic assessments that foster innovation, compliance, and market leadership in the evolving world of financial technology.

Trending blog:

- https://www.prnewswire.com/news-releases/north-america-used-truck-market-to-surpass-usd-24-43-billion-by-2030-fueled-by-fleet-renewal--regulatory-shifts--markntel-advisors-302595305.html

- https://www.prnewswire.com/news-releases/us-snacks-market-to-surpass-usd-193-51-billion-by-2030-driven-by-protein-rich-formulations--ai-powered-personalization--markntel-advisors-302595304.html

Reach Us:

MarkNtel Advisors

H-159, Sector 63, Noida, Uttar Pradesh-201301, India

Contact No: +91 8719999009

Email: sales@marknteladvisors.com

Visit our Website: https://www.marknteladvisors.com

We’re always open to sharing insights, exploring ideas. Follow us to stay updated on the latest news and industry trends.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness